Three stories, the same message.

How Glen Powell ended up with the role of Hangman in Top Gun: Maverick.

How Estée Lauder ended up in Harrods.

David Senra tells the story in Founders #217. First Lauder goes to Harrods. No one talks to her. So, she thinks a little media attention will help. She does some interviews, goes back to Harrods, no one talks to her. She returns to America.

Lauder returns a year later. She asks. ‘No’. More media, she asks again, ““she talks to the same buyer. This is a year later. She was not as quite as hostile, but she says, let me tell you, I have no room here as I told you before, she said, but perhaps I could take a tiny order and put it in with the general toiletries.”

More media, and the customers started to show up.

How Kind Bars ended up in Walmart.

Daniel Lubetzky’s path to starting Kind was long, wandering, and full of two-steps forward one-step back moments. One was the first time Kind got into Walmart. It wasn’t in the bar section. It wasn’t in the health foods. It was in the candy bar section.

This was disappointing but a blessing in disguise. Kind lacked the organizational structure required for serving large customers. The bars took a long time to take off – which was good. Once they did Walmart and Kind ended their partnership. It was too much too soon – but a lesson in what the company needed next.

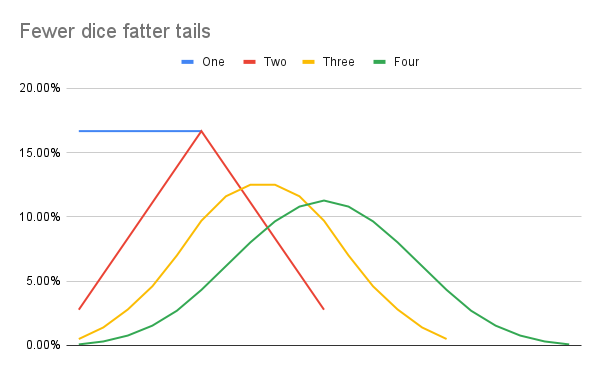

Everyone is a genius in a bull market, but is it easier to choose bull markets than be a genius?