The rule of thumb for an emergency fund is three to six months of expenses. The specifics depend on a host of factors like fixed costs, number of incomes, and type of job. In the Need for Speed post we suggested how Variance Response Time might affect someone’s budget. The theory was that an excellent salesperson would have a faster and higher quality response (i.e. new job like the old job) faster than a teacher.

What was implicit in that post was the idea of being precise or being accurate.

At the end of March 2020 during the coronavirus pandemic I compared our family’s emergency fund to our previous month of expenses. Aside from travel for work and weekend activities, our monthly spending was flat.

Dollars devoted to dining out were diverted to stocking up. Weekend activities become home activities.

How long would this ‘as-is’ lifestyle last using our emergency fund? The good news was that it would last five months.

But that begat more questions. If this were a true emergency how long could we last? Cutting out the extra expenses like Netflix, home repairs and maintenance, and Target and our runway ran up to eight months.

Okay, but how long could we really go? What if we tapped our home equity, liquidated a 401k (and paid the 35% penalty), and sold one car? That would mean things were really bad but we could still survive for a long, long time. A room, a roof, and rack in oven goes a long way in those conditions.

These calculations were all in a spreadsheet and so the numbers were nice and precise. And probably wrong. Here’s how James Allworth put this idea on Exponent 184:

“Something I learned early on in consulting was when clients came to you with problems you needed to model them in some way or another and I remember, early on in my career, being really proud about building very sophisticated models with different variables. It could handle all kinds of things.

“One of the partners came along and started to use it, and he laughed. He’s said, ‘James, one thing that you really need to understand if you want to be effective in situations, especially ambiguous situations, is understanding the difference in precision and accuracy.”

That wasn’t in my spreadsheet. Our ‘needed’ 401k was unlikely to be worth as much as it is today, reduced as it is. That car I might sell couldn’t be given away. If things were that bad there were would be so many more sellers than buyers.

At the 2009 annual meeting, Warren Buffett was asked how he calculates value if he doesn’t use a discounted cash flow.

Warren whimsically recalls Aesop’s fable about a bird in the hand being worth two in the bush. Investing, Buffett said, is all about the exchange of the bird in the hand, “But the real question is, how many birds are in the bush? You know you’re laying out a bird today, the dollar. And then how many birds are in the bush? How sure are you they’re in the bush? How many birds are in other bushes? What’s the discount rate?”

He goes on to say, “we do not sit down with spreadsheets and do all that sort of thing. We just see something that obviously is better than anything else around, that we understand. And then we act.”

Charlie anything to add? Yes, Munger says, “I’d say some of the worst business decisions I’ve ever seen are those that are done with a lot of formal projections and discounts back.”

For an emergency fund then, more is better but anything is good. With so much uncertainty there are good ways to gamble. Ian Cassel told Patrick O’Shaughnessy that he tries to keep his fixed costs low and his variable costs variable. If someone has saved and can scale their expenses, then they have an emergency fund. Too much spreadsheeting leads to numbing numbers.

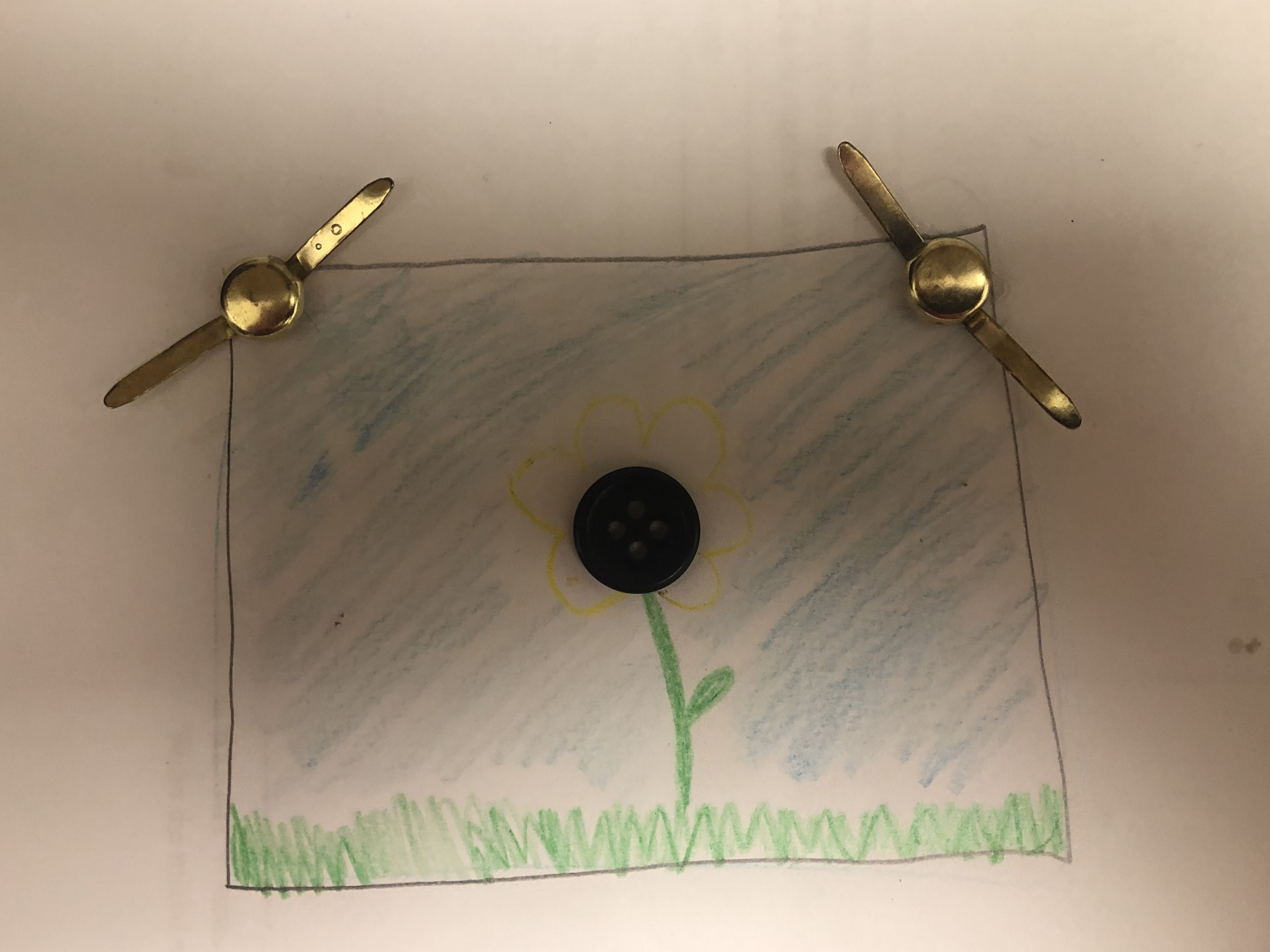

We’ve gotten quite creative with making breakfast.