Right around thirty-two, most people ask this question: should I get a 15 or 30-year mortgage?

When my wife and I wondered this we had some of the personal-finance challenges licked (hedonic adaptation, envying the Joneses, etc.). A fifteen-year mortgage felt like the responsible choice because delayed gratification is almost always worth it.

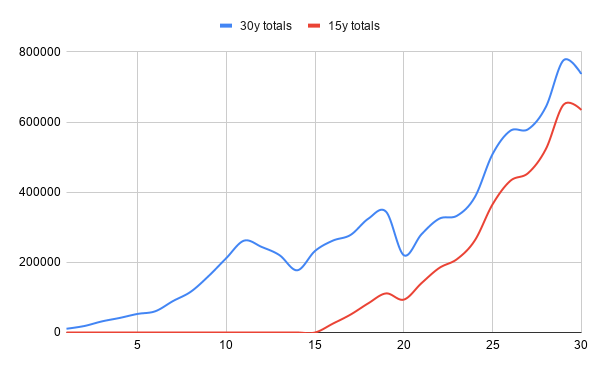

However, there was opportunity cost to consider. If we chose the lower monthly payments that go along with the longer payment period we could invest the difference. Using a selection of actual returns of the S&P500 over the last thirty years here’s what the number said: it doesn’t matter.

Subtract total house payments (extra interest) from total investment gains and the total difference is twenty-thousand dollars.

Fifteen or thirty? Doesn’t matter.

Another question that pops up for parents is paying for college. It just so happens—and I double-checked the math—that a fifteen-year mortgage started when a child is three, finishes when that child turns eighteen and may head off to college. Mortgage payments become tuition payments. Clean and easy.

This doesn’t matter either.

All that matters is choosing from good options. With hindsight one option will be better than the others, but that prediction is impossible.

A lot of time we want THE BEST. Early in life, I compared televisions, computers, and cars on all the listed attributes (I hadn’t read Sutherland). Now I try to think about what the good options are and pick one.

Much of life is too complex to optimize but not so complex to neglect.

I like this one Mike, I’m with you there.

hope you guys are doing great. miss hanging out.

Tim timhofmann.org

On Tue, Jan 7, 2020 at 10:48 AM The Waiter’s Pad wrote:

> MIKE posted: ” Right around thirty-two, most people ask this question: > should I get a 15 or 30-year mortgage? When my wife and I wondered this we > had some of the personal-finance challenges licked (hedonic adaptation, > envying the Joneses, etc.). A fifteen-year mort” >

LikeLiked by 1 person

Thanks Tim. Was thinking about you the other day while filling another pot with cold brew

LikeLike

[…] (Mike Dariano) SECURE Act Retirement Quotes Mindset Personal finance […]

LikeLike

[…] the numbers on a fifteen or thirty-year mortgage with the mindset to invest the difference and both are good choices. Avoiding mistakes is more than […]

LikeLike

[…] was talking to a neighbor about refinancing a house and shared these calculations. Looking back, a re-fi is like putting trees on a building. It’s flashy, it’s easy to […]

LikeLike

[…] research was like mortgage choices. Is a fifteen year mortgage better than a thrity year where someone can invest the difference the […]

LikeLike

[…] someone spends less on the big (non-salient cost) things, they’ll probably be fine […]

LikeLike

[…] of life is a cooking problem. Should you pay off your mortgage or invest? That’s a cooking problem. Cooking problems have leeway because there’s not a lot of […]

LikeLike

[…] get caught in this metric. But personal financial success seems to be mostly choosing from the good options, having good luck, and remembering da moon. Inverted: it’s not getting caught up with the […]

LikeLike

[…] get caught in this metric. But personal financial success seems to be mostly choosing from the good options, having good luck, and remembering da moon. Inverted: it’s not getting caught up with the […]

LikeLike

[…] exercises, working late/early) but which have positive n+1 effects and so they are worth doing. Personal finance follows this diagram for example. Parenting according to Stixrud and Johnson follows it too. It […]

LikeLike

[…] The techniques I learned in my Ohio high school still work: remove the bad answers first. Like the 15y or 30y mortgage question, I’m looking for choosing from only the good options. At the extreme, pulling demand […]

LikeLike

[…] improvements “at the margin” is not the model. Most of life is answering questions like a 15 or 30 year mortgage? Most of life is just choosing from the good options, not finding the best one to the nth […]

LikeLike

[…] Bobby’s plan is different from mine. But I don’t know that he’s wrong. Personal finance is more like cooking than baking. We looked at, for instance, a 15 or 30 year mortgage? […]

LikeLike

[…] around here is to choose from pretty good options. Emergency funds should be generally right, both 15 and 30 year mortgages are good choices, and personal finance expertise is from experience not […]

LikeLike

[…] touched on this idea in the Maximizing a 401k post and considered the tradeoffs between a 401k and a 15-year mortgage […]

LikeLike

[…] second aspect is framing the choices rather than making the choices. Choosing from good options, 30 or 15 Year Mortgages?, takes less time and works just as fine. A list of pros and cons doesn’t make a lick of […]

LikeLike