The LEGO Group was founded in 1932 by Ole Kirk Kristiansen and the story is told in The Lego Story by Jens Andersen.

The takeaway, like all successes, is to work hard and get lucky. Rather than a review, let’s tour history through industry.

1919, Denmark’s economy slows. “Farmers in Billund and other districts benefited from Denmark’s neutrality during the First World War, by selling grain and meat to the warring nations and earning some extra hard cash by producing peat.” When farmers have money they can pay carpenters like Ole Kristiansen. And if farmers don’t, they can’t.

1925, a fire in Ole’s woodshop. This will be a recurring theme.

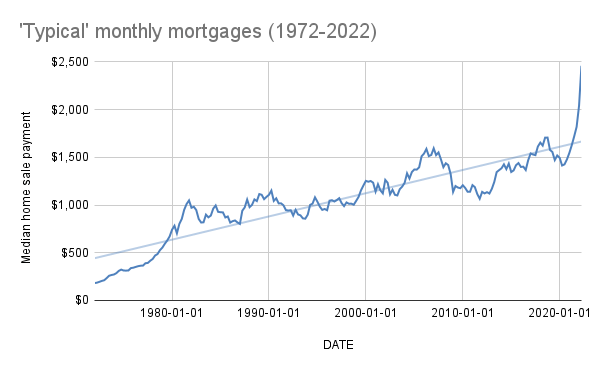

1929, the depression. “For a while, the future looked promisingly bright, but shock waves from the Wall Street Crash in October 1929 that wiped out billions of dollars in wealth quickly spread to Europe. Germany and England, Denmark’s biggest trading partners, were badly affected, and the price of grain, butter, and pork crashed.”

1932, anything that sells. Though woodworking had been his trade, it was the 1931 Yo-Yo craze that inspired Ole to make toys. “By the 1930s, yo-yo-ing had become a nationwide fad,” writes Chat GPT, “with tournaments and competitions being held across the country.” Ole’s brothers and sisters want to know why a good carpenter would waste his time, “I think you’re much too good for that, Christiansen—why don’t you find something more useful to do!”

1933. “We worked like dogs, my wife, my children, and I, and gradually things began to pick up. Many days we were working from morning till midnight, and I bought a cart with rubber wheels so the neighbors wouldn’t be disturbed when I took the packages to the station late at night.”

1940, Germany invades Denmark. Though occupied (and part of the resistance group, running grenades to saboteurs in LEGO boxes) it was a good time for LEGO. Parents were “keen to protect their children from hardship,” and during the five years of occupation, LEGO’s revenue grew.

1942, another fire in the woodshop.

1946, plastics? Ole buys a plastic molding machine. Through the early 1950s executives at LEGO will say no no no, plastic toys will never take off.

1947, Ole sees his first plastic brick from an English toy manufacturer. This is the seed for LEGO but will prove a thorn in their intellectual property side for decades to come.

1951, the top-selling LEGO toy is the (plastic molded) Marshal Plan-delivered Ferguson tractor.

1955, LEGO bricks roll out to toy stores.

1956, LEGO bricks roll out to Germany. Andersen writes, “Selling toys in Germany would be like selling sand in the Sahara.” LEGO advertises in one city, Hamburg, creating a two-minute film to play before features. Word spreads.

1958, good news, LEGO invents the tube on the underside of the LEGO brick. Ole Kirk passes away and his son Godtfred takes over.

1962, the Scale Model Line. Godtfred grows up playing LEGO, so do other people. What if we make LEGO for professional adults? The Scale Model line is for engineers to design with LEGOs. Even the everyman could create his own house. The project fails but leads to the 1/3 size pieces ubiquitous in today’s sets.

1968 LEGOLAND Denmark opens. It’s a hit.

1976 oil crisis. “A significant part of LEGO’s challenges in the 1970s could be ascribed to two separate oil crises, a stagnating global economy, Denmark’s falling birth rate, and a declining toy market abroad.”

1978 minifig enters. Lego, Kjeld Kristiansen notes, has three phases: blocks, wheels, and mini-figures.

1989 LEGO pirates. But Gameboy too.

…

If there’s one consistent lesson through each decade of LEGO it’s the importance of sales. Every few years someone comes along and says the toys are good enough and every few years someone else reminds them but we have to sell these things. It’s just hard work.