I finished Janet Lowe’s book, Damn Right about Charlie Munger with a fat stack of notecards on the book. That makes sense, I assumed, Munger has a lot to teach. Then I reread my first post on Charlie Munger and saw that there was little overlap. Few ideas from the first book I read about Munger was notable in the second book about Munger. How great is that!

The first, Tren Griffin’s Charlie Munger focuses more on the investing side and Lowe’s is more of a biography.

I can only hope that the lack of overlap means I’m smarter. That in the first book I learned first book kind of things and in the second I was a touch wiser.

Munger is like a modern-day Benjamin Franklin and we all have a lot to learn from him, but shouldn’t imitate him. I liked what Griffin wrote in this first chapter of his book.

“The point is not to treat anyone like a hero, but rather to consider whether Munger, like his idol Benjamin Franklin, may have qualities, attributes, systems, or approaches to life that we might want to emulate, even in part.”

Here are some of those approaches.

1/ Finish line fallacy. “Charlie judges himself by an inner scorecard – and he’s a tough grade.” – Warren Buffett

The goal isn’t to win someone else’s race but to run your own. Lowe writes that “envy strikes him as the silliest of the seven deadly sins since is produces nothing pleasant at all. To the contrary it simply makes the practitioner feel miserable.”

At the 2016 Berkshire Hathaway meeting Munger addressed this as it related to Geico, “I don’t think it’s a tragedy that one competitor had a little better ratio one period…I don’t think we should worry about the fact that somebody else had a good quarter.”

Jason Calacanis said his finish line is to be the #1 angel investor, not some series of returns. Ryan Holiday warned Shane Parrish about writers angling toward the wrong finish line. Jason Fried pointed out that you can’t be Jeff Bezos, “His success is one that’s very very hard to achieve…most likely you won’t get there…the odds are stacked against you…and if you think that’s the only way you’re going to be miserable.”

Run your own race.

2/ FU money. “I had considerable passion to get rich. Not because I wanted Ferraris – I wanted the independence.” – Munger

One of my favorite internet niches is financial independence. People like Mr. Money Mustache and the Mad Fientist not only have super cool-dorky names, but they also tell another story. One where you bike to work, invest huge portions of your income, and live moderately. Their story is important, to paraphrase Auren Hoffman, because it shows that the default doesn’t have to be the only option.

The backbone to financial independence is the freedom when you don’t have to work. Many FIers keep working because they like it. They have the freedom to someday not go. That’s the idea I got from Munger.

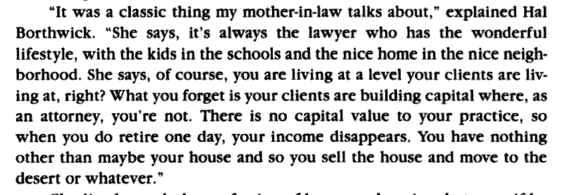

In Damn Right, Munger’s son Hal explains how you get FU money:

Nassim Taleb writes in The Black Swan that this means independence:

When/If you don’t need to listen to other people your worldview changes. There are two sides to this balance, one the financial independent bloggers report, income and expenses. Taleb’s big payout meant his income was large enough to cover his current expenses. Munger learned this too. Ben Horowitz found this in his business under the name “positive cash flow.”

3/ Other’s opinions. “Everybody engaged in complicated work needs colleagues. Just the discipline of having to put your thoughts in order with somebody else is a very useful thing…we (Buffett and Munger) both think the other one is worth listening to.” Munger

One valuable cog in the machine of organization is having smart people around and listening to them. Karl Rove said the Bush White House had this. Bill Belichick encourages this on his football teams.

Assistant coaches say that Belichick is approachable, so long as you have your facts right. Former vice president of player personnel Scott Pioli said that part of the annual evaluation system of coaches was “whether or not you have an opinion,” and “Bill never discouraged me. Because even when we disagreed and got into it, he never discouraged me from having a different opinion.” Belichick wants his coaches to talk to him and push back.

Good organizations do this. Andy Grove said that part of the reason Intel succeeded was because they had “broad and intensive debates.” “We developed a style of ferociously arguing with one another while remaining friends,” wrote Grove.

Smart arguments are in places of genius too.

For this to work the boss has to listen. Belichick listened, Grove listened, and Buffett listens to Munger.

Anson Dorrance is the winningest college soccer coach but he needs his assistant Bill Palladino, because as Palladino says, “no one else is going to say no to Anson.”

Former CEO of Coca-Cola, Donald Keough writes that these sorts of relationships are requisites of success, and in The Ten Commandments for Business Failure he points out Munger explicitly:

“When teams of leaders complement and balance one another (as in the case of Warren Buffett and Charlie Munger at Berkshire Hathaway, Tom Murphy and Dan Burke at CapCities, or Frank Wells and Michael Eisner at Disney), then one person’s shortcomings can often be offset by another’s strengths.

Failure to do this, writes Keough leads to isolation, which, “carried to its most extreme form, tends to breed a sense of almost divine right.”

4/ Youth soccer coaches don’t get 10,000 hours. “Up here we went fishing. We were always making fires. The rest of the year we didn’t see him much.” Charles Munger Jr.

“I think my mother gave him an incredible amount of latitude to concentrate on his affairs and career. She did everything in the home.” Emilie Munger

It’s hard, maybe impossible, to be world class at something and do much else in life. Malcolm Gladwell popularized the idea of 10,000 hours, but he clarified that his point wasn’t to set a bar, but to note how high it was. There’s an opportunity cost to expertise.

John Boyd was the greatest American fighter pilot and made huge contributions to the philosophy of war, but he was never nominated for “Dad of the Year.” In his book on Boyd, Robert Coram writes in the epilogue, ” John Richard Boyd – as is often the case with men of great accomplishment – gave his work far greater priority than he did his family. The part of his legacy that concerns his family is embarrassing and shameful.”

Steve Jobs was not a stellar father.

NASA Flight Director Gene Kranz wrote, “Behind every great man is a woman – and behind her is the plumber, the electrician, the Maytag repairman, and one or more sick kids. And the car needs to go into the shop.” Rorke Denver said he couldn’t be a Navy SEAL if not for his wife doing the family stuff.

One of my favorite books on productivity is Laura Vanderkam’s 168 Hours. Vanderkam looks at time use surveys and concludes that the problem isn’t a lack of time, but a misuse of time. Subtract a fifty hour work week and eight hours of sleep each night and you still have almost 9 hours a day for other things. This idea isn’t new. Two thousand years ago Seneca wrote,

It is not that we have a short time to live, but that we waste a lot of it. Life is long enough, and a sufficiently generous amount has been given to us for the highest achievements if it were all well invested.

But these people who make a dent in the world seem to be at another level. Their professional commitments are all-consuming. Their work takes a huge bite out of a finite pie. These people don’t/can’t be the youth soccer coach – heck, they probably won’t even attend any games.

5/ XMBA (night and evening curriculum). “(Munger) began investing in securities and joining friends and clients in business endeavors, some of which prove to be graduate-level courses in the school of hard knocks.” – Janet Lowe

When I articulated the idea of the XMBA, it only existed as an option different from college. You could, like David Chang, Tim Ferriss, Sophia Amoruso, or Elizabeth Gilbert consciously replace “school learning” with “life learning.” That does work, but Munger’s actions point to a better model.

That model is that you are always learning. Seth Klarman said, “I learned an enormous amount there (Mutual Shares), probably more than in my subsequent two years of business school.”

When I taught at college the students always told me that the things they learned in the field were 10X as valuable as the things we taught on campus.

That’s what happened to Munger. He learned from life. That’s really important.

I didn’t internalize this until I found Shane Parrish‘s Farnam Street blog. Whoa, I thought, you can read, think, and talk about ideas? I assumed after college that I was mostly done. I was wrong.

Getting things right later in life is about learning from the things earlier in life. Warren Buffett said, “If we hadn’t bought See’s (candy), we wouldn’t have bought Coke.” Notice how easy it is to change the nouns and verbs and have your own lessons for life.

- If I hadn’t dated Kim, I wouldn’t have married Jan.

- If I hadn’t failed Economics, I wouldn’t have the motivation to finish my degree.

- If I hadn’t taken that early meeting with Ben, I wouldn’t have the opportunity to start my business.

The key isn’t the particulars, but the sequence, which comes because you paid attention and learned something.

I still believe the XMBA is a good idea, a real alternative to college thanks to technology. But it stands on the foundation that is lifelong learning. You don’t need an MBA if you are a lifelong learner.

6/ Be different and be right. “Graham often told his students that there were two requirements for success on Wall Street; the first is to think correctly and the second is to think independently.” Janet Lowe

You have to be different and you have to be right.

In the recent post on Instagram, we looked at how they pivoted from being a gamified-check-in app to a photo-sharing-social-network. We guessed that they followed the different and right idea.

First, they were right because they imitated what had been working. Check-in apps were the right direction. There was something to this smartphone in your pocket. The Instagram founders said that they knew people wanted to use the phones in their pockets to share their view of the world with others. They thought that view was as check-ins.

Imitation is a good way to figure out what’s right. Look at what others are doing and just do that. It’s wrong to stop there, you have to be different too.

Second, Instagram became different. Foursquare and Gowalla were slugging it out and Burbn (the precursor to Instagram) had to move on to something else. They did when one of the founders went on vacation and had a simple conversation with his girlfriend about how filters make photos look better.

Second, Instagram became different. Foursquare and Gowalla were slugging it out and Burbn (the precursor to Instagram) had to move on to something else. They did when one of the founders went on vacation and had a simple conversation with his girlfriend about how filters make photos look better.

Howard Marks coined the idea of being different and right, and its value has been demonstrated in other domains too. Bill Belichick was different when he focused on studying film and physical preparation for each season. Bill Gurley pointed out that startups in VR aren’t interesting to him because they aren’t different enough. The big players like Samsung, Facebook, and Google will likely crush those startups. Instead he said, “Most big startup breakouts are where people aren’t paying attention.” What’s more different from that? Milton Hershey was different in that he made milk chocolate.

7/ Some things are worth more. “Ben Graham had blind spots. He had too low an appreciation of the fact that some businesses were worth paying big premiums for.” – Munger

Bill Gurley saw this with Google. When asked about why he didn’t invest, Gurley said:

“I think it came down to the price at the time was remarkably high and the team was remarkably self-confident in a way that would cause you to question whether they could pull it off but they did. I go back and the learning is that if you have remarkably asymmetric returns you have to ask yourself, ‘how high could up be and what could go right?’ because it’s not a 50/50 thing. If you thought there was a 20% chance you should still do it because the upside is so high.”

If we can figure out what’s valuable and what’s worthless we can buy the former, when it’s expensive or cheap.

Athletes are a proxy for investments and this thinking applies. Lebron James is one of the best players in the NBA (valuable) and landed on his first team via a high draft pick (expensive).

Tom Brady is one of the best football players in the NFL (valuable) and landed on his first team via a low draft pick (cheap).

The hardest part of this is picking out the valuable from the worthless. Long Term Capital Management was an expensive, but valuable investment until it suddenly wasn’t. Darko Milicic was an expensive but worthless NBA player. Once you get good enough at finding valuable assets, you can hone this philosophy. It’s what Munger says they did:

“See’s Candy was acquired at a premium over book (value) and it worked. Hochschild, Kohn, the department store chain, was bought at a discount from book and liquidating value. It didn’t work. Those two things together helped shift our thinking to the idea of paying higher prices for better businesses.”

Warren Buffett added, “I became very interested in buying a wonderful business at a moderate price.”

8/ Patience to wait. “I think the record shows the advantage of a peculiar mind-set not seeking action for its own sake, but instead combining extreme patience with extreme decisiveness.” – Munger

Jack Schwager said that his success in investing is thanks to patience. Buffett’s addressed this too. Gary Vaynerchuk warned about impatience out of the box. Louis C.K. had patience to make his show Horace and Pete.

Munger sees Berkshire Hathaway’s patient capital as a supreme asset.

Patience isn’t the only part of Munger’s quote, you need decisiveness too. That means knowing what the right situation looks like. It means pattern recognition and reading books and having good decision makers around you. It means winning hinge plays.

The podcast and post about Instagram had a point about hinge plays, what they mean and why they are important. The Instagram founders said that a key decision to their success was choosing an open graph over a closed one. That’s a hinge play, a fork in the road, a bifurcation. One way leads to one collection of outcomes, one way leads to another.

Patience and knowledge allow you to wait until you get to the really big ones, and the understanding to know which way to go. Bill Belichick looks at third downs as hinge plays. Warren Buffett has said certain investment decisions are hinge plays.

“You’d get very rich if you thought of yourself as having a card with only twenty punches in a lifetime, and every financial decision used up one punch. You’d resist the temptation to dabble. You’d make more good decisions and you’d make more big decisions.”

To put it one other way; Wait, wait, wait, GO!

9/ Read books by dead people. “I think you when you’re trying to teach the great concepts that work, it helps to tie them into the lives and personalities of the people who developed them. I think that you learn economics better if you make Adam Smith your friend.” “I frequently like the eminent dead better than live teachers.” – Munger

Do you realize how amazing this is? That you can be friends with Munger, Smith, or anyone else? Seneca wrote that the dead are never too busy to see you and will happily share what they’ve learned. Munger’s work too is available to anyone with an internet connection.

Not only that, BUT IT’s FREE! All it costs is your time.

10/ Low overhead. “I don’t know of anybody our size who has lower overhead than we do, and we like it that way. Once a company starts getting fancy, it’s difficult to stop.” Munger

What I didn’t know about Munger before this book was that he’s been successful his entire life. He went to the University of Michigan, Caltech, and Harvard Law. He was a successful lawyer with successful investments before he teamed up with Buffett. He’s never been poor.

Or dumb.

Warren Buffett makes compound interest a lead role in many of his stories and a high overhead might be the foil. Excessive overhead is credit card debt, compounding the wrong way.

When Sophia Amoruso started her company she kept a low overhead, always stair-stepping (never rushing) to larger sizes, websites, and employees. Eventually her company moved into a large space and she took a vacation. Upon her return she saw Herman Miller chairs. Amoruso writes:

There was no way that I was going to have interns rolling around on these things! It sent the wrong message to the company to preach frugality while balling out on twelve grand worth of chairs. You can’t act like you’ve arrived when you’re only just receiving the invitation.

“Once a company starts getting fancy, it’s difficult to stop.” In part because we hate losing things.

We feel loses more intensely than we feel gains. Mix into that inertia and status quo and you have a soup of entitlement, expectations, and emotions. If you supervise a business, division, or family, keep a low overhead.

11/ Decentralized command. “We’ve decentralized power in our operating businesses to a point just short of total abdication.” -Munger

The right people making the right decisions is a powerful tool. In episode 035 of my podcast we looked at different areas where this works.

- Pete Carroll does it in football by asking his players what they need to succeed.

- NASA flight director Chris Kraft helped his engineers by relieving political pressure from them saying yes.

- The Skunk Works team used decentralized command to build the world’s best aircraft.

- The University of Utah let people like Ed Catmull run around and do what they were most interested in.

- Andy Grove used it to get Intel out of one area of expertise and into another.

Decentralized command is the feature that lets organizations move faster with less oversight and wasted time and money.

12/ Luck and skill. “(US Air) worked out fine for Berkshire. But we’re not looking for another experience like it…(airlines are) a very leveraged business. So when the industry turned, it turned beautifully – for US Air included.” Munger.

One tenet of Buffett and Munger’s work is the idea that capital should be distributed where it can do the most work. Their investment in GEICO and the accompanying insurance “float” is often cited as the gasoline that makes this engine run.

The float is invested in the best opportunities that Buffett and Munger can find, and those returns more than outpace what GEICO needs to return in claims.

Buffett and Munger’s focus is in areas where they can have the most success, and that dictates areas where they have some ability to control the outcome.

Airline returns have too many things that can’t be controlled. Even if Munger follows the right process, he can still be wrong. We’ve seen how sports like soccer and football have this too.

Chriss Sacca told Jason Calacanis in his September 2016 podcast, “We invest in things where we feel we can personally move the needle. Instead of just throwing darts in the board like in the public market, I want to know, is this a company that we can help.” Mark Cuban says this about his Shark Tank TV deals too.

These investors all look for things where they can make a specific difference. They look for places with causation between effort and outcome.

Thanks for reading,

Mike

[…] Insights from Janet Lowe’s "Damn Right" about Charlie Munger. (thewaiterspad) […]

LikeLike

[…] a few key theories (“A few really big ideas carry most of the freight,” says Charlie Munger ) you’ll run shorter and more accurate […]

LikeLike

[…] Charlie Munger said, “We’ve decentralized power in our operating business to a point just short of total abdication.” Munger and Buffett trust their employees. […]

LikeLike

[…] books written about them are ‘achievers.’ We look at them because they did something. Charlie Munger is often cited for his brilliance in finance, mental models, and investing. Munger is a father […]

LikeLike

[…] Newport writes that rare and valuable jobs require rare and valuable skills. Charlie Munger writes that successful capital allocation is “not supposed to be easy. Anyone who finds it […]

LikeLike

[…] think like him, but not completely. This is true of a lot of partnerships. The Warren Buffett and Charlie Munger duo is like this. Ditto for Marc Andreessen and Ben Horowitz. Bill Belichick and Ernie Adams have […]

LikeLike

[…] addition to solving the last thing though, let’s extend our understanding using a technique Charlie Munger and Seth Klarman suggest; […]

LikeLike

[…] Pabrai said that when he was starting his investing partnership he just did what Warren Buffett and Charlie Munger did. Pabrai didn’t need to know the why, just the […]

LikeLike

[…] Charlie Munger thought that being a lawyer would lead to wealth. Then he started working with business owners and he realized that it was business owners, not their lawyers, who created valuable assets. Munger changed course. Oh, it’s businesses, not people, that create value. […]

LikeLike

[…] has it for football. Sam Hinkie and Phil Jackson for basketball. Yvon Chouinard for apparel. Charlie Munger puts it this way for investing, you better know the other side’s position better than they […]

LikeLike

[…] This is the start of stasis. We have the companies that Warren Buffett and Charlie Munger look for, ones that can’t be upended by any amount of […]

LikeLike

[…] stacking. One way to succeed is to be great at a few things, the other is to be good at many. Charlie Munger is the latter. So is Scott Adams. Fisher says that companies can be like this too and calls it […]

LikeLike

[…] 10K hours. Wright was committed to his work and not much else. Charlie Munger never coached youth soccer. Gene Kranz of ‘failure is not an option’ fame […]

LikeLike

[…] we’ve covered Munger before; using Damn Right (post), the 2017 Daily Journal Meeting, and using Tren Griffin’s Book (twice!). Today’s […]

LikeLike