Supported by Greenhaven Road Capital, finding value off the beaten path.

Rather than a notes post, this one will be a summary page about one idea; being different.

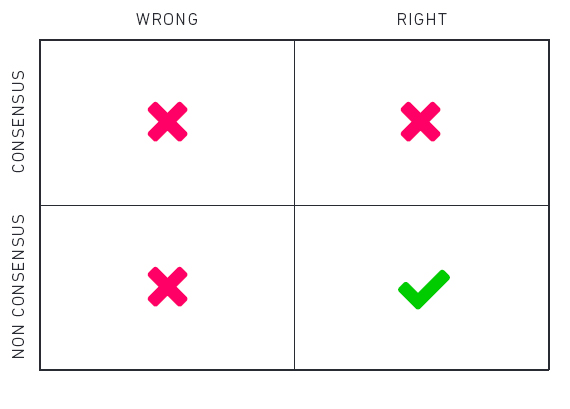

This repeats in different interviews because people want to start something new. The want comes from a dissatisfaction. Where succeed by being different and right. Howard Marks 4 puts it this way:

This is simple but not easy. You have to do things that others think stupid, said Pat Dorsey. These are non-obvious things, said Jason Calacanis. These are ideas that people are opposed to. Leigh Drogen [said]:

“Union Square Ventures finds that when they go into a partner meeting with an idea they want to see a barbell of, ‘I think that’s an awesome idea’ and ‘you’re freaking crazy, why would we ever do that?’ Their worst investments are the ones where everybody thinks, ‘yeah that makes total sense.'”

What kind of person. A hard one. Rishi Ganti suggested people become more like Indiana Jones. Scott Fearon wrote that loners, cynics, and skeptics do better. Marc Cohodes said about short-selling “if you’re not a tough motherfucker you shouldn’t do this.”

Where to look. Somewhere you know well. Before Alton Brown created a hit cooking show he made television for ten years and went to culinary school. Danny Meyer followed a similar path, focusing on a certain type of NYC eateries. Andy Rachleff said, “to be non-consensus and right you have to have tremendous knowledge of your domain.”

You want El Dorado, without conquistadors or tourists. Rishi Ganti pointed out that the pricing mechanism – and you only need two bidders – create markets. You want to be the only eBay bidder.

These things can have unconventional pricing. Moneyball was all about finding mispricings because of incorrect labeling. It’s something Joe Peta found too when he bet on baseball. Crypto, for example, is a different pricing.

What to build. If you find an opportunity then build with care. This is paramount. Andy Rachleff calls it product market fit and says it “trumps everything else.” Scott Galloway said that product comes before marketing six days a week and twice on Sunday. In Zero to One, Peter Thiel wrote that early on everyone is a builder or seller.

Good builders talk to their customers. Do not confuse friends, family, or spreadsheets for customers. This means physical proximity. Melanie Whelan goes to spin classes. Scott Norton threw a ketchup party. Matt Wallaert went into a classroom to talk to teacher and students.

Alpha erosion. If the new thing works congratulations, you have what investors call alpha. Don’t get comfortable. Alpha will be eroded unless it is protected by a moat, these are powerful and rare.

It’s why Daryl Morey said that their draft board isn’t so different anymore. Competing teams noticed that Morey’s team tended to draft well and copied, tinkered, and remixed it. Ed Thrope said: “any edge in the market is limited, small, temporary, and quickly captured by the smartest or best-informed investors.”

Career risk. Only certain companies allow for this kind of “being different.” You don’t get fired for buying Blackstone, said Ganti. Wesley Gray said that getting crushed in the short-term with good long-term strategies is “the biggest issue with arbitrage.” In Michael Lewi’s other book Flashboys he wrote:

“It wasn’t all that hard for the people who ran Goldman Sachs to see the source of the problem, or to see why no one inside the system cared to point it out. “There’s no upside in it—that’s why no one ever steps out on it,” said (Matt) Levine. “And everyone’s got career risk. And no one is thinking that far ahead. They are looking at the next paycheck.””

Simple and valuable, but not easy.

Thanks for reading.

Learn how to write. Barely under stable.

LikeLike

[…] There’s only one way to succeed: be different. (thewaiterspad) […]

LikeLike

[…] Sei anders! (Englisch, thewaiterspad) Dieser Artikel könnte auch ohne Probleme in die Rubrick «Trading» passen. […]

LikeLike

[…] Be Different is […]

LikeLike

[…] a whole post about the advantages in Being Different. Meb doesn’t want to launch a low-cost fund to compete with Vanguard or another me too […]

LikeLike

[…] you liked the Be Different post, you’ll love this […]

LikeLike

[…] his resignation letter, Sam Hinkie pointed out the importance of being different. We covered that here […]

LikeLike

[…] different. Being Different is advantageous. It means approaching stale problems in fresh ways. Luhnow’s career arc is an […]

LikeLike

[…] already had a post about Being Different. It was like the song of the year though, so it gets repeated […]

LikeLike

[…] investors have to Be Different. “Don’t just do things other people do.” Instead, have a “willingness to […]

LikeLike

[…] Typical analytic situation have three potentials for improvement (or, competition). […]

LikeLike

[…] in any small group. To outperform, bet chalk. **However in a large group, choose variance.** Be different, and be right. We know that something will happen. We just don’t know which […]

LikeLike